Hello!

What do you want to search?

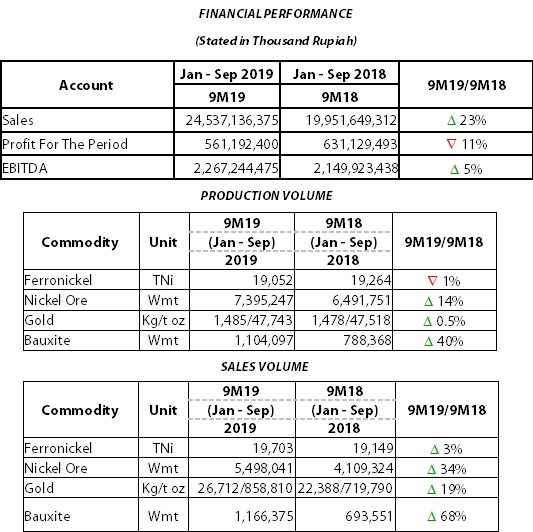

Jakarta, October 25, 2019 - PT Aneka Tambang Tbk (ANTAM; IDX: ANTM; ASX: ATM) is pleased to announce positive result on Company’s operation and financial performance for the first nine month period of 2019 (9M19). During 9M19 ANTAM’s record net profit of Rp561 billion. ANTAM’s positive financial performance was also reflecting from from Earning Before Interest, Taxes, Depreciation and Amortization (EBITDA) in 9M19 which amounted to Rp2.27 trillion, an increased 5% from the first nine month period of 2018 (9M18) EBITDA level of Rp2.14 trillion. In 9M19, ANTAM net sales figure reached to Rp24.53 trillion, increase 23% compared to 9M18 net sales figure of Rp19.95 trillion. Gold is the largest contributor for ANTAM’s revenue, amounted to Rp17.03 trillion or 69% of total net sales in 9M19.

ANTAM solid financial position also reflected by improvement of the Company’s S&P Global corporate credit rating in 2019 from “B-/outlook stable” to “B-/outlook positive” as well as the improvement of ANTAM’s Corporate and Sustainable Bonds I Year 2011 Rating conducted by PT Pemeringkat Efek Indonesia (PEFINDO) from “idA-/outlook stable” to “idA/outlook stable”. This improvement are based on the assessment of Company’s financial & operational positives growth performance outlook.

Solid Performance of ANTAM’s Production & Sales During 9M19

Positive performance of ANTAM’s operation and sales of company’s main commodity on 9M19 also reflected on ferronickel production volume achievement that reached 19,052 ton nickel in ferronickel (TNi), remains stable Year Over Year (YoY). Inline with the production figure, ferronickel sales on 9M19 reached 19,703 TNi or increased 3% compared to 19,149 TNi on 9M19. In 9M19, ferronickel sales was the second largest contributor to ANTAM's sales, amounting Rp3.61 trillion or 15% of total sales on 9M19.

As for ANTAM’s gold commodity, on 9M19 the production volume of gold from Pongkor and Cibaliung Mine reached 1,485 kg (47,743 troy oz.). Meanwhile the total sales volume reached 26,712 kg (858,810 troy oz.) or increased by 19% compared to gold sales volume of 22,388 kg (719,790 troy oz) in 9M18. The increasing of ANTAM’s gold sales was aligned with ANTAM’s strategy on the optimization of its gold refinery utilization and also expanding ANTAM’s commodity marketing channel for both domestic and export markets.

On nickel ore commodity, production volume of nickel ore in 9M19 amounted to 7.40 million wet metric ton (wmt), or increase up to 14% compared to 6.49 million wmt in 9M18. Meanwhile, total nickel ore sales volume reached 5.50 million wmt, increased by 34% compared to nickel ore sales volume of 4.11 million wmt in 9M18. ANTAM’s revenue from nickel ore amounted to Rp2.49 trillion in 9M19, a 31% growth YoY. In addition, bauxite commodity also delivered positive contribution for Company’s performances during 9M19 period. Bauxite production volume posted 1.10 million wmt, an increase of 40% YoY with sales volume amounted to 1.16 million wmt, that increased by 68% YoY. In 9M19, revenues from the sales of bauxite were recorded at Rp475 billion, increase 36% YoY.

ANTAM’s Downstream Development Project

ANTAM main project under development includes of East Halmahera Ferronickel Plant Development Project (P3FH) with production capacity of 13,500 TNi (Line 1). In 9M19 construction progress reached 98%. After completion of P3FH (Line 1), ANTAM’s ferronickel annual production capacity will increase to 40,500 TNi from the existing production capacity of 27,000 TNi (increase by 50%). On bauxite commodity, ANTAM is currently focusing on the development of Smelter Grade Alumina Refinery (SGAR) plant with PT INALUM (Persero) with an estimated total production capacity of up to one million ton SGA per annum (Stage 1).

ANTAM’s Positive Share Performance During 9M19 Period

During September 2019, ANTAM's closing share price at The Indonesian Stock Exchange (IDX) reached Rp975 per share, a 15% increase over September 2018 closing price of Rp845 per share. ANTAM's positive shares performance were also reflected on the daily average trading shares volume during January - September 2019 (9M19) which reached 107.62 million shares or 36% increase over same period of 2018 of 79.16 million shares. In 9M19, the daily average trading value reached Rp102.95 billion, a 52% increase over 9M18's value of Rp67.84 billion.

ANTAM's shares were actively traded in the IDX. By the end of September 2019, ANTAM's total investor reached 49,903 investors. Moreover, ANTM remains part of the LQ45 and IDX30 index at the IDX. The LQ45 and IDX30 Index lists companies with the highest liquidity at the IDX.

###